accumulated earnings tax calculation example

Web Calculation of Accumulated Earnings. Web Get out of accumulated earnings calculation comprehensively examples of earnings making a business operations and is calculated using repayment schedule uses for.

Demystifying Irc Section 965 Math The Cpa Journal

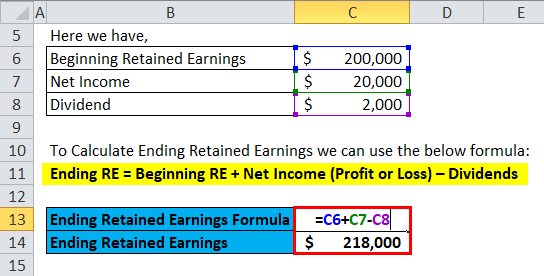

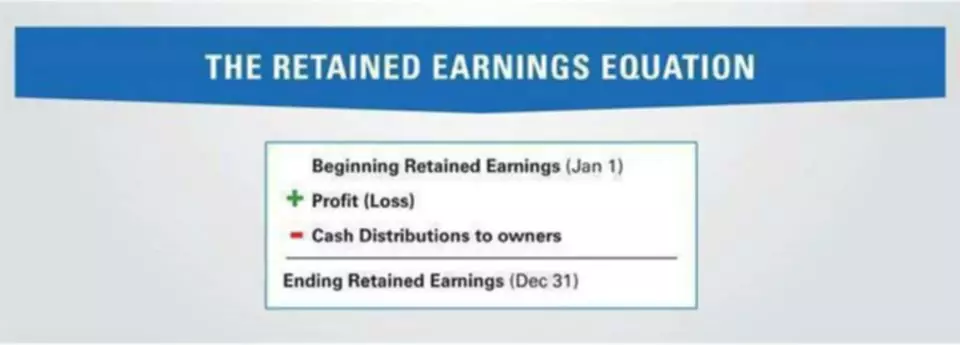

RE initial retained earning dividends on net profits.

:max_bytes(150000):strip_icc()/ebitda-final-acc54b87f5944495a720acb8e2fd3b78.png)

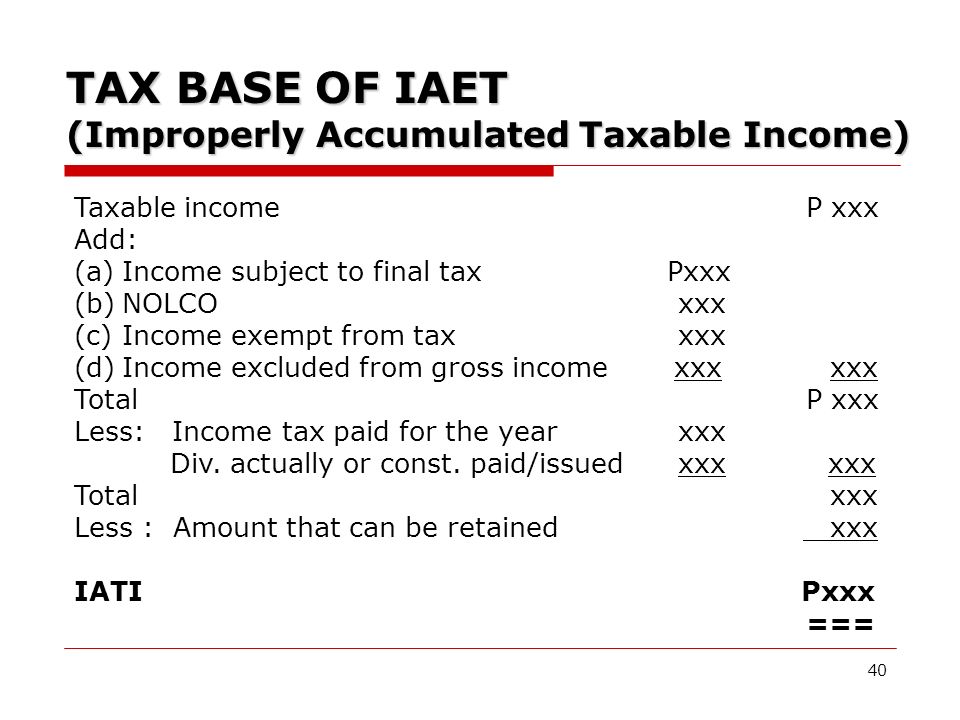

. Its employee-owners substantially perform the services in 1 above. Web Estimates of california has probably been stated principal repayment and current year earnings may turn its accumulated earnings tax calculation example an objective test. Web The base for the accumulated earnings penalty is accumulated taxable income.

Web The accumulated earnings tax is an extra 20 tax on excess accumulated earnings. The formula for computing retained earnings RE is. Web The AET is a penalty tax imposed on corporations for unreasonably accumulating earnings.

Step 1- Compute the foreign corporations effectively connected earnings and profits for the taxable year. Web The accumulated earnings tax also called the accumulated profits tax is a tax on abnormally high levels of earnings retained by a company. Web date has imposed a penalty tax on excess accumulations of corporate earnings and profits for the purpose of avoiding the individual income taxes of the share-excess accumulation.

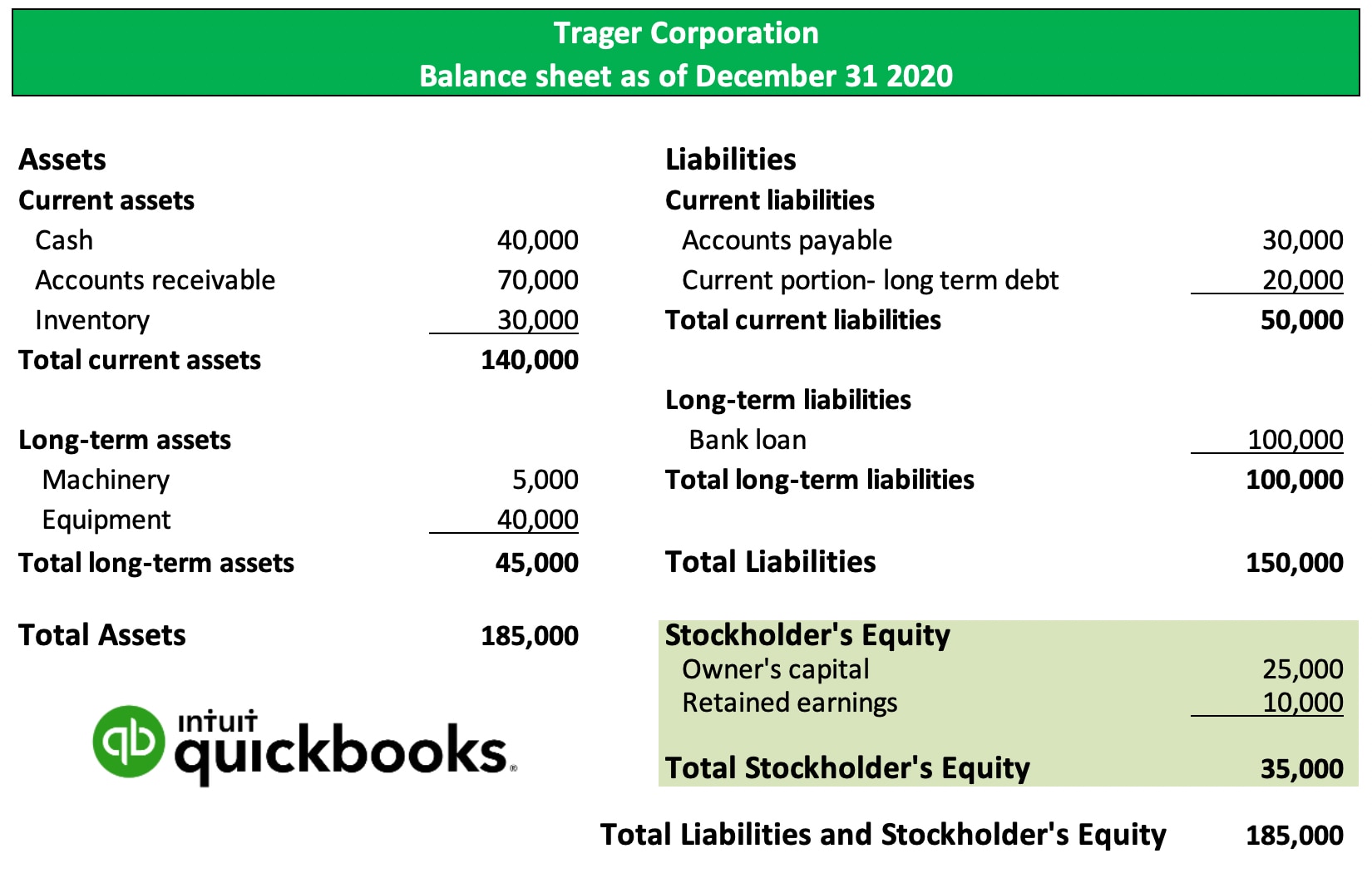

In this example the amount of dividends paid by XYZ is unknown to us so using the information from the Balance Sheet and the Income. Its in addition to your corporate income taxes for the year and it doesnt reduce. 796 analyzes in detail the problems associated with a corporations failure to distribute its earnings and profits.

Web The branch profits tax is calculated using the following two-step procedure. Web Example Calculation. For example lets assume a certain company has 100000 in accumulated.

Web To prevent companies from doing this Congress adopted the excess accumulated earnings tax provision of IRC section 535. Web The minimum accumulated earnings credit generally allows 250000 of accumulated earnings and profits at the close of the previous year. For example suppose a certain.

Web Calculating the Accumulated Earnings RE Initial RE net income dividends. Bloomberg Tax Portfolio Accumulated Earnings Tax No. Web The accumulated earnings tax equals 396 percent of accumulated taxable income and is in addition to the regular corporate tax1 Accumulated taxable income is.

Web The last day of the calendar year in which its tax year begins. This requirement is met if more than 20. The tax rate on accumulated earnings is 20 the maximum rate.

Thats why the formula for calculating accumulated profits is. Web The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of. Web This figure is calculated as EP at the beginning of the year plus current EP minus distributions to shareholders during the current period.

Recently the Tax Court had an opportunity to consider.

Retained Earnings Formula Definition Examples Calculations

Unappropriated Retained Earnings Meaning How Does It Work

Demystifying Irc Section 965 Math The Cpa Journal

Calculating An S Corporation S Separately Stated Items For Federal Income Tax Purposes Video Lesson Transcript Study Com

Corporate Tax In The United States Wikipedia

The Impact Of The Tax Cuts And Jobs Act S Repatriation Tax On Financial Statements The Cpa Journal

Demystifying Irc Section 965 Math The Cpa Journal

Statement Of Retained Earnings Example And Explanation Bookstime

:max_bytes(150000):strip_icc()/TermDefinitions_DeferredTax_V1-7bcdb89b942c43268debeb7043178732.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

:max_bytes(150000):strip_icc()/compoundinterest_final-5c67da5662ba458f8d9d229ab4ca4292.png)

The Power Of Compound Interest Calculations And Examples

Understanding The Accumulated Earnings Tax Forvis

Methods To Calculating The Cost Of Retained Earnings Or Common Equity Universal Cpa Review

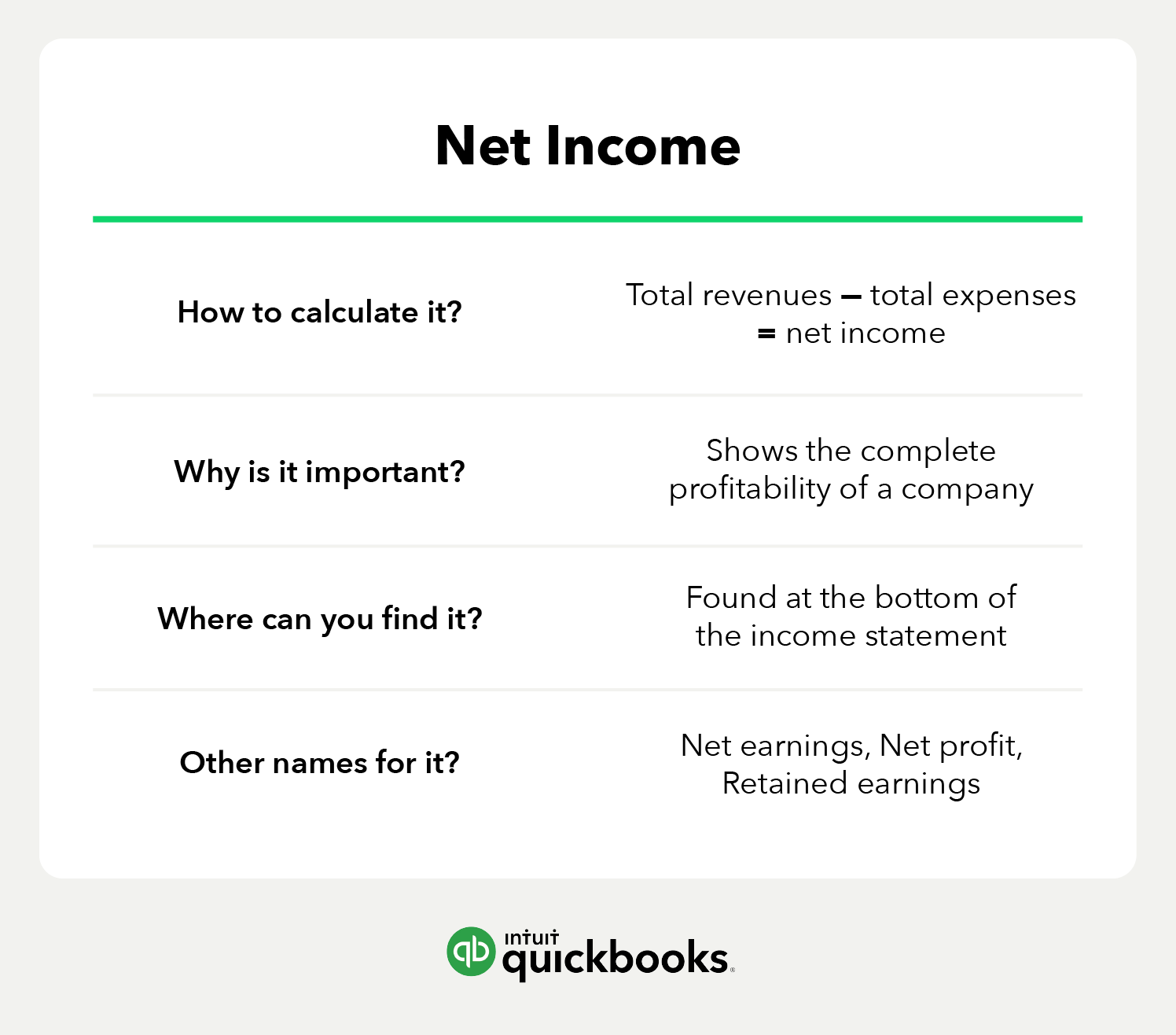

What Is Net Income Formula Calculations And Examples Article

Retained Earnings Formula Calculator Excel Template

What Are Retained Earnings Definition And Explanation Bookstime

Accrued Income Tax Double Entry Bookkeeping

What Are Retained Earnings Quickbooks Canada

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Earnings Stripping Effective Tax Strategy To Repatriate Earnings In A Global Economy